Exploring the landscape of private health insurance across different countries reveals a myriad of options and factors influencing affordability. From government policies to healthcare quality, the quest for the best countries for affordable private health insurance unveils a fascinating journey worth exploring.

As we delve deeper into the realm of private health insurance, we uncover key insights and comparisons that shed light on the intricacies of this essential aspect of healthcare.

Factors to Consider When Choosing a Country

When it comes to choosing a country for affordable private health insurance, there are several key factors to consider. These factors can greatly influence the cost and quality of healthcare services available to you.

Cost of Healthcare Services

The cost of healthcare services in a particular country plays a significant role in determining the affordability of private health insurance. Countries with lower healthcare costs tend to have more affordable insurance premiums. This is because insurance companies base their rates on the overall cost of medical care in a given location.

Therefore, it is important to consider the average cost of medical procedures, doctor's visits, and prescription medications when choosing a country for private health insurance.

Quality of Healthcare Services

Another important factor to consider is the quality of healthcare services in different countries. While cost is a major consideration, it is equally important to ensure that the healthcare services available are of high quality. Countries with top-notch medical facilities, well-trained healthcare professionals, and advanced technology may have higher insurance premiums, but they also offer better healthcare outcomes.

It is essential to strike a balance between affordability and quality when selecting a country for private health insurance.

Countries with Affordable Private Health Insurance Options

When it comes to affordable private health insurance, some countries stand out for offering accessible and cost-effective options to their residents. These countries have implemented policies and systems that prioritize the well-being of their citizens while keeping healthcare costs manageable.

1. Germany

Germany is known for its robust healthcare system, which includes a mix of public and private insurance options. The government mandates that everyone must have health insurance, but private insurance is often more affordable than in other countries. Additionally, there is a high level of competition among insurance providers, which helps keep premiums reasonable.

2. Switzerland

Switzerland is another country with a reputation for affordable private health insurance. The government regulates the insurance market tightly, ensuring that costs remain reasonable for residents. Additionally, Swiss insurance plans often offer comprehensive coverage, including access to top-tier medical facilities and specialists.

3. Netherlands

In the Netherlands, private health insurance is mandatory for all residents, but the government provides subsidies to help lower-income individuals afford coverage. The insurance market is highly competitive, with a wide range of options available to consumers. This competition helps drive down costs and ensures that residents have access to quality healthcare services.

4. Australia

Australia's healthcare system combines public and private insurance options, with private insurance being relatively affordable for many residents. The government provides incentives for individuals to take out private insurance, such as tax rebates and premium support. This helps ensure that Australians have access to timely and high-quality healthcare services.

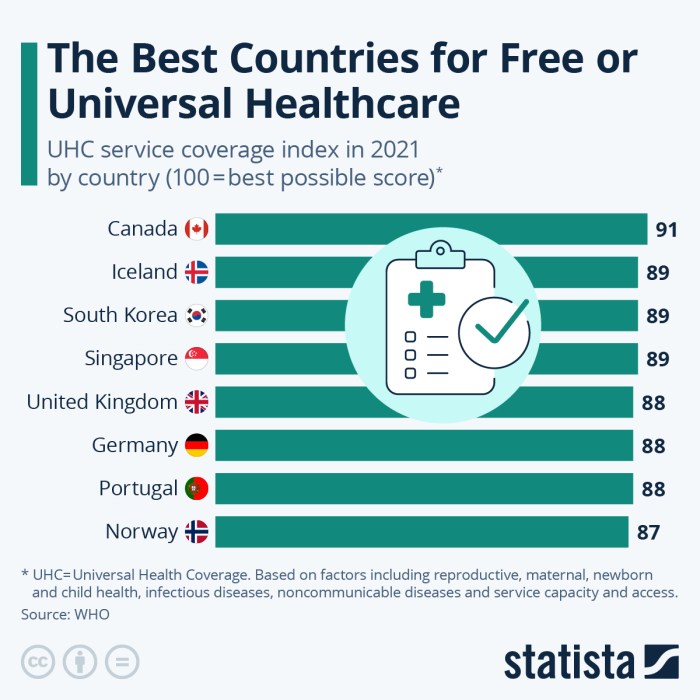

5. Singapore

Singapore is known for its efficient and affordable healthcare system, which includes a mix of public and private insurance options. The government heavily regulates the healthcare market to keep costs in check, and residents have a wide range of insurance plans to choose from.

Additionally, Singapore's healthcare system emphasizes preventive care, which can help reduce long-term healthcare expenses.

Comparison of Private Health Insurance Systems

Private health insurance systems vary significantly from country to country, impacting the affordability and accessibility of healthcare services for individuals. Let's explore how different countries structure their private health insurance systems and how these structures influence overall affordability.

United States

In the United States, private health insurance is predominantly employer-based, with individuals and families purchasing plans either through their employer or on the private market. This system often leads to high premiums and out-of-pocket costs, making healthcare less affordable for many Americans.

The lack of a universal healthcare system also contributes to the high cost of private health insurance in the U.S.

Germany

Germany has a unique healthcare system that combines both public and private health insurance options. While everyone is required to have health insurance, individuals can choose between the public statutory health insurance system or opt for private health insurance

Singapore

Singapore operates a system of mandatory savings accounts known as MediSave, which can be used to pay for medical expenses, including private health insurance premiums. The government also provides subsidies for lower-income individuals to help make private health insurance more affordable.

This innovative approach has helped Singapore maintain relatively affordable healthcare costs.

Australia

Australia has a mixed public-private healthcare system, with a universal public insurance scheme (Medicare) that covers basic healthcare services. Private health insurance in Australia is encouraged through tax incentives and provides coverage for services not covered by Medicare. This system aims to reduce the burden on the public healthcare system while still ensuring affordable access to quality care.

Japan

In Japan, private health insurance supplements the national health insurance system, covering additional services and reducing out-of-pocket costs for individuals. The government regulates premiums to ensure affordability, and competition among insurers helps keep costs in check. This combination of public and private insurance options has helped Japan maintain a relatively affordable healthcare system.

Summary

Overall, the structure of a country's healthcare system plays a crucial role in determining the affordability of private health insurance. Countries that have a mix of public and private options, government regulation of premiums, and innovative approaches to healthcare financing tend to have more affordable private health insurance options for their residents.

Tips for Finding the Best Private Health Insurance

When it comes to finding the best private health insurance, there are several factors to consider. From coverage options to cost and limitations, it's important to do your research and compare different plans before making a decision.

Researching and Comparing Private Health Insurance Options

- Start by researching the private health insurance options available in different countries. Look into the coverage provided, the network of healthcare providers, and the reputation of the insurance companies.

- Compare the premiums, deductibles, and out-of-pocket costs of different plans. Consider what services are covered and any exclusions that may apply.

- Read reviews and testimonials from current policyholders to get an idea of the customer experience and the ease of making claims.

Evaluating Coverage, Cost, and Limitations

- Consider the level of coverage provided by each plan. Make sure it includes the services you need and offers adequate protection in case of emergencies or major medical expenses.

- Compare the cost of premiums, copays, and deductibles. Factor in any potential out-of-pocket expenses to determine the overall affordability of the plan.

- Be aware of any limitations or restrictions in the policy. This could include waiting periods for certain treatments, exclusions for pre-existing conditions, or limits on the number of visits allowed.

Understanding the Fine Print and Exclusions

- Take the time to carefully read through the policy documents and understand the terms and conditions. Pay attention to any exclusions or restrictions that may impact your coverage.

- Look for details on how claims are processed, what documentation is required, and any deadlines for submitting claims. Understanding the claims process can help you avoid any delays or denials.

- Consult with an insurance advisor or healthcare professional if you have any questions or need clarification on specific aspects of the policy.

Last Recap

In conclusion, the quest for the best countries for affordable private health insurance is a dynamic exploration of various factors and considerations. By understanding the nuances of different systems and policies, individuals can make informed decisions to secure optimal coverage at reasonable costs.

Essential Questionnaire

How do government policies impact the affordability of private health insurance?

Government policies can regulate insurance markets, introduce subsidies, or enforce mandatory coverage, all of which can influence the affordability of private health insurance.

What are some strategies for evaluating the coverage of private health insurance plans?

It's important to carefully review the coverage limits, inclusions, exclusions, and network of providers when evaluating private health insurance plans.

Are there any trends or innovations in private health insurance that are reducing costs?

Technological advancements, telemedicine services, and data analytics are some of the innovations in private health insurance that are contributing to cost reduction in certain countries.